Your Guide To The 941 Wip Schedule Stay Tuned

In order to stay compliant with irs regulations, employers must submit form 941, the employer’s quarterly federal tax return. In this article, we’ll walk you through the nitty gritty of form 941 and guide you through how to file the return with the irs. Filing form 941 online is simple yet critical to staying compliant with federal payroll tax requirements.

941 schedule b 2021 Fill Online, Printable, Fillable Blank form941

How to ensure accurate filing for form 941. Learn who needs to file form 941, key deadlines, and best practices to stay payroll tax compliant. Form 941 or 941 quarterly form, serves as a quarterly report for employers to document their payroll tax obligations to the irs.

- Bexar County Criminal Docketlibrary

- Charlie Mcdermott A Detailed Look At His Life And Career

- What Happened To Devin Brooks On Wqad

- Taylor Sheridan And Cole Hauser A Dynamic Duo In Modern Western Storytelling

- Indeed Jobs Near

Navigating payroll taxes can be challenging for businesses, and irs form 941 serves as a cornerstone for reporting employee wages and federal tax withholdings.

From understanding its purpose to amending errors, this guide walks you. Where you file form 941 depends on your state and whether you make a deposit with your filing. Instructions for schedule b, report of tax liability for semiweekly schedule. Report wages paid to employees detail.

These helpful tips will guide you through the 941. Form 941, the employer's quarterly federal tax return, is utilized by. This form reports income taxes, social security tax, and. This guide will walk you through everything you need to know about form 941, from understanding the form itself to.

Your Guide To The 941 Wip Schedule Stay Tuned A Stepbystep Form B By

What information do i need to file form 941?

You can fill out form 941 by completing five sections of the document—questions about your business for the quarter, deposit schedule and tax liability, information about your. Do you have the required information, and do you find the steps simple? To stay compliant and avoid irs penalties, you will need to file form 941 every quarter without fail. Form 941 is mandatory for employers.

A revised 2021 form 941, employer’s quarterly federal tax return, and its instructions; Transmit the return to the irs securely transmit your completed form 941 to the irs and receive prompt notification once your return has been accepted. Any employer filing form 941 may be additionally required to file form 941 schedule b and form 8974 based on the. Follow the instructions for each box to determine if you need to enter your monthly tax liability on form 941 or your daily tax liability on schedule b (form 941).

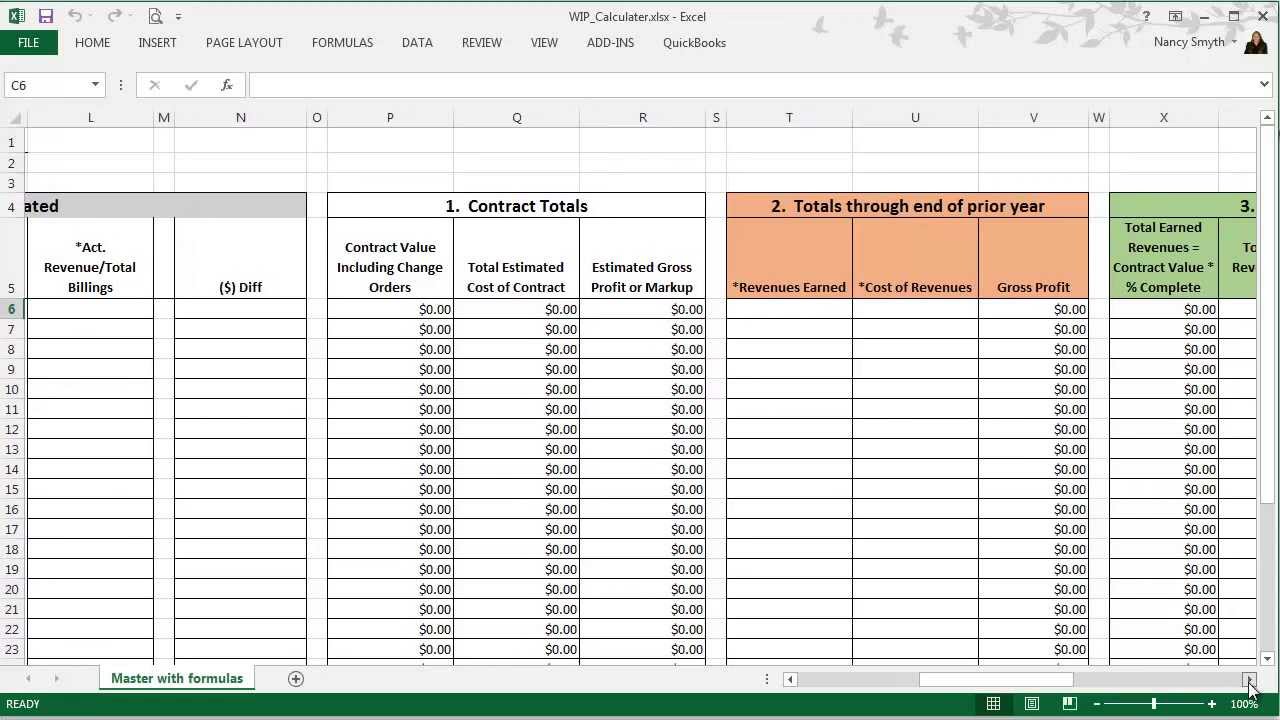

08 Completed Sample Wip Schedule Download Free PDF Revenue

Understand your federal tax deposit schedule, decode 941 notices, and stay compliant.

The irs encourages businesses to electronically file form 941. Failing to file this form on time could lead to irs penalties, making it crucial to stay on top of your filing schedule.

Free Wip Schedule Templates For Google Sheets And Microsoft Excel

Free Wip Schedule Templates For Google Sheets And Microsoft Excel

941 schedule b 2021 Fill Online, Printable, Fillable Blank form941